SRQ DAILY Dec 30, 2017

"With the floodgates now open, large institutional pools with infinite lifespans, such as university endowments, have allocated a sizeable percentage of assets to hedge funds, private equity and venture capital. "

The Sarasota City Commission recently approved a lease for the Lido Beach Pavilion that has the potential to tie up what is arguably the City’s most important public asset at a bargain basement price (from $80,000 to potentially $140,000 a year) for the next 30 years. In the most recent meeting regarding this lease, the Commission’s confusing deliberations had the three supporting Commissioners not only wholly accepting the applicants’ attorney Bill Merrill’s arguments that an enforceable contract exists, but these Commissioners seemed to argue the applicants’ case for them. These three attorneys on the City Commission outlined why they legally believed there was no turning back. In doing so, you have to wonder if they truly appreciated what they were doing and whose interests they are supposed to represent. A subsequent memo to the City Commission from another attorney, John Patterson, raises important questions.

Bill Merrill provided the Commission a number of examples of case law indicating that the approval of the lease must stand. But, as Mr. Patterson pointed out in his memo, Merrill’s examples were relevant to leases that resulted from RFPs (Requests for Proposals), or bids. The City’s lease negotiations were the result of an ITN—Invitation to Negotiate—not an RFP. The two are substantially different, and an ITN is subject to the City’s procurement code, which states: “The CITY reserves the right to accept or reject any or all Responses, in whole or part, for any reason whatsoever…”

John Patterson also points out in his memo that no City Commissioner has seen a completed proposed lease, which the ITN expressly requires. I requested a copy of the approved lease a few days ago and was told that it wasn’t ready yet. If the City’s ITN procurement code requires the lease to be in writing before it can be approved, it appears the City Commission’s vote on the non-existent Lido Beach Pavilion lease should be invalid.

Another fundamental question raised in the Patterson memo—can the City negotiate with an entity that doesn’t legally exist? According to documents, the City negotiated with “Lido Beach Redevelopment Partners LLC.” However, Patterson points out that Lido Beach Redevelopment Partners LLC “was never formed. It has never had a corporate name; a corporate address, officers or directors; assets; financial statements or any other indication of ‘financial responsibility’; no taxpayer identification number; no employees; no company history; no experience providing the products and services called for in the ITN; or any authority to conduct business in Florida.” An ITN requires detailed information about the entity or person with whom the City may enter into a lease. Given that the named negotiating entity has no legal existence, again it appears the City’s vote on this lease should be invalid.

Patterson also points out that the City Charter requires a supermajority affirmative vote from four or more Commissioners to approve any lease for greater than 10 years. This lease was “approved” by a 3-2 vote.

Mr. Patterson’s memo makes mincemeat out the claim that the vote on this lousy lease is legally valid. His arguments are worth consideration by anyone concerned with the future of Lido Beach Pavilion, and certainly by the City Commissioners who owe us due diligence in the management of this hugely valuable City asset. Commissioners would do well to understand what City residents protesting this lease know: it never should have happened.

The question of what investments are suitable for funds held in trust, for a finite period or in perpetuity, for the benefit of private persons or corporations, has engaged the legal and financial communities for centuries.

The oft-cited “prudent man rule” originated in a seminal court case involving Harvard College and Jonathan and Francis Amory, both trustees of a fund of $50,000 established by their brother and cousin, John McLean. The fund was to distribute current income to the late McLean’s wife, Ann, and upon her death the residuum, or corpus, of the trust was to be given to Harvard College and Massachusetts General Hospital. The trustees selected what many fiduciary advisors would view as an inappropriate weighting towards equity securities (100 percent) and no allocation to fixed-income instruments. After the passing of Mrs. McLean, just over $29,000 remained in the trust. Harvard sued the remaining living trustee, Francis Amory, and argued placing the entirety of the trust’s assets in common stock, which offered no security of principal and jeopardized the interests of the ultimate beneficiaries of the trust, Harvard College and Massachusetts General Hospital. The court, siding with defendants, decided trustees acted as any prudent person would, given their skill level in the context of the economic backdrop at that time.

This legal precedent established a wide scope of discretion in which trustees could operate when constructing and managing portfolios. Thirty years later, the New York Court of Appeals greatly narrowed the list of acceptable investments permitted under the prudent man rule.In essence, government bonds and notes backed by a pledge of real estate (mortgage securities) were designated as the only acceptable investment for funds held in trust. This thinking stands in stark contrast to today’s modern portfolio management techniques.

Nearly a century after King v. Talbot, Harry Markowitz in 1952 introduced to the world Modern Portfolio Theory. MPT postulates that when a portfolio blends securities that lack strong correlations, security-specific, nonsystemic risk can be neutralized and “diversified away.” Thus volatility originating from any one security or sector or asset class is dampened, and returns attributed to the overall market can be captured. William Sharpe, in 1966, built on the MPT foundation by focusing not just on the directional price relationship of combinations of securities in a portfolio (co-variance) but also on the aggregate risk-return characteristics across a portfolio. Managers desire to construct portfolios that optimize the risk-adjusted return, garnering the largest possible return over the risk-free rate, per unit of “risk” as measured by standard deviation. Visually, this concept is depicted by graphing the efficient market frontier.

The work of Markowitz, Sharpe and others, paired with two studies published by authors working under the Ford Foundation, elevated the importance of capital appreciation to the same level as principal preservation and current income. The resulting approach, dubbed “total return investing,” is intended to preserve the real purchasing power of endowments for the benefit of current and future generations. The codification of these related concepts is represented by the 2006 Uniform Prudent Management of Institutional Funds Act and signed into law in 2011 by Gov. Rick Scott.

So, with the floodgates now open, large institutional pools with infinite lifespans, such as university endowments, have allocated a sizeable percentage of assets to hedge funds, private equity and venture capital. An As reported by Pensions & Investments’ James Comtois, for fiscal year 2017 ending June 30, “The average 12-month return for the large US endowments in P&I’s universe … was 13.2 percent vs. 1 percent for the prior year.” The range of returns among the 31 universities was wide, with Grinnell College clocking in at 18.8 percent ($1.9 billion endowment) and Harvard’s $37.1 billion pool returning 8.1 percent. For FY 2016, Harvard lost 2 percent. Note Harvard’s fund has been undergoing a significant restructuring involving the shuttering of internally managed funds, with a shift toward external managers. Harvard excluded, the other 30 higher-education endowments on P&I’s radar saw returns averaging in the low-to-mid teens for FY 2017.

At Cumberland Advisors, we are not exuberant supporters of “2-and-20” hedge funds and other alternative investments. Multi-year lock-out periods, the relinquishing of custody of donor funds to general partners, onerous fee structures, and lack of real-time reporting and transparency inherent in these partnerships all provoke a healthy dose of skepticism. We express reservation particularly in regard to lack of public oversight in the management of 501(c)(3) monies. In contrast to the near total transparency involved in the selection and monitoring of managers for state and local government pools, the public has little access to the inner workings of investment committees of community foundations, colleges and other not-for-profits.

The Pensions and Investments article referenced above with 1, 5 and 10-year average returns of endowments of over $500 million, as reported by the Wilshire Trust Universe Comparison Service. The Vanguard Balanced Index Fund’s Semiannual Report, which includes average annual total 1,5 and 10-year returns.

The jury is still out on whether the inclusion of exotic instruments is necessary or appropriate for perpetual pools of funds supporting charitable activities.

Gabriel Hament is an investment adviser representative at Cumberland Advisors.

Bee Ridge Lighting and Design shined bright last year as the Best Lighting Fixture source, with Erin Delia Glueck saying that, “ I can always count on Bee Ridge Lighting for having the chicest options.” Will they reign supreme again this year? Cast your vote today!

As part of its Season of Sharing program and fund distribution, Community Foundation of Sarasota County recently awarded JFCS of the Suncoast $50,000 for families in need. The funds will provide emergency support to local families who have special needs or extenuating circumstances that require financial support including:

- First month and/or past due rental assistance, mortgage payments or other housing assistance

- Utility payments/deposits

- Emergency help with moving and/or storage

- Child care or summer day care expenses for working families in emergency situations

- Transportation assistance to and from work, car repair and/or medical appointments

- Clothing, such as uniforms, necessary to gain employment

- Required work tools for people with confirmed employment

- Emergency food vouchers

“JFCS is most appreciative of the Community Foundation of Sarasota County grant as part of its Season of Sharing campaign that allows us to respond and provide financial support in a timely manner to families in emergency situations and help them continue to lead productive lives,” said Heidi Brown, CEO of JFCS.

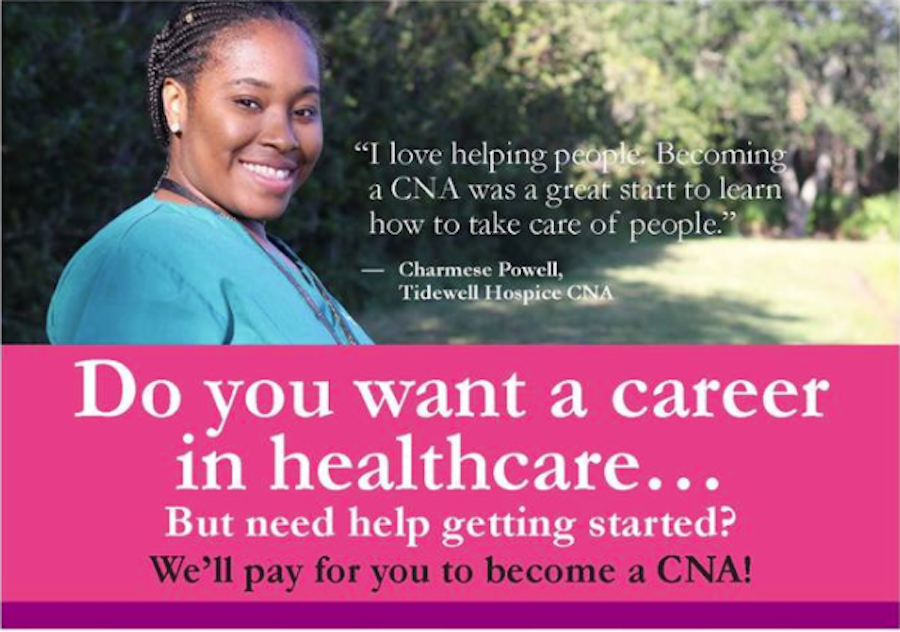

Tidewell Hospice, the American Red Cross and CareerEdge are offering a free Cer- tified Nursing Assistant (CNA) training program with guar- anteed employment for eligible participants interested in a healthcare career. The costs of tuition and the state exami- nation fee will be covered for those chosen for the program. Participants will only be responsible for their medical exam and the purchase of scrubs. Upon successful completion of the training program, the CNA graduates will be guaranteed employment at Approved Home Health or Tidewell Hospice, with starting wages between $12 and $13 per hour. The pro- gram will run January 22 through March 31, 2018 and classes will be held at the American Red Cross office in Sarasota. Prospective participants are invited to a end one of three information sessions from 5:30-7:30 pm on December 12, 28 and January 4. Please RSVP for the information sessions at cnascholarships.eventbrite.com

Forty Carrots Family Center has received a $10,000 grant from the PNC Foundation for its Partners In Play groups, to provide free, weekly parenting ed- ucation and early childhood education in all 15 Sarasota and Manatee County Libraries. PNC provided the funding through Grow Up Great, its initiative to help prepare children from birth to age 5 for success in school and life.

Goodwill Manasota is embark- ing on a new partnership with the Healthy Start Coalitions of Sarasota and Manatee counties that will result in addition- al resources to help newborn children in our community. Goodwill’s Good Futures Program will now include classes for new mothers in Goodwill community rooms throughout Sarasota and Manatee counties. Through its Job Connec- tion program, Goodwill’s free career services will include one-on-one work with new mothers to provide jobs skills, re- sume writing and employment-search training. Goodwill will also host a diaper drive, and the community is encouraged to drop off diapers and wipes to benefit Healthy Start clientsat Goodwill donation centers.

On December 4, Florida Studio Theatre held the official dedication for the opening of the Kretzmer Artist Housing Project located on Cohen Way in the growing Rosemary District. These five new townhomes help to fill the pressing need for quality housing that is safe, accessible, and within close proximity to downtown. Project supporters, FST artists, Board members, and FST staff all gathered to celebrate the completion of this new artistic home. “This is where it all begins,” said Producing Artistic Director, Richard Hopkins. “This is where the artist lives. The Kretzmer Artist Residence is the cornerstone of an artistic community; A community that will inspire collaboration among the many different artists, interns, and apprentices who work diligently and tirelessly to inspire, challenge, and entertain on FST’s five stages.” After breaking ground on the project back in October of 2016, the structure was completed just one year later in November of 2017.

SRQ DAILY is produced by SRQ | The Magazine. Note: The views and opinions expressed in the Saturday Perspectives Edition and in the Letters department of SRQ DAILY are those of the author(s) and do not imply endorsement by SRQ Media. Senior Editor Jacob Ogles edits the Saturday Perspective Edition, Letters and Guest Contributor columns.In the CocoTele department, SRQ DAILY is providing excerpts from news releases as a public service. Reference to any specific product or entity does not constitute an endorsement or recommendation by SRQ DAILY. The views expressed by individuals are their own and their appearance in this section does not imply an endorsement of them or any entity they represent. For rates on SRQ DAILY banner advertising and sponsored content opportunities, please contact Ashley Ryan Cannon at 941-365-7702 x211 or via email |

Powered by Sarasota Web Design | Unsubscribe